Multiple Choice

On 1 July 2013 Bryson Ltd sells a machine to Adams Ltd in exchange for a promissory note that requires Adams Ltd to make five payments of $8000,the first to be made on 30 June 2014.The machine cost Bryson Ltd $20 000 to manufacture.Bryson Ltd would normally sell this type of machine for $30 326 for cash or short-term credit.The implicit interest rate in the agreement is 10%.What are the appropriate journal entries to record the sale agreement and the first two instalments using the net-interest method?

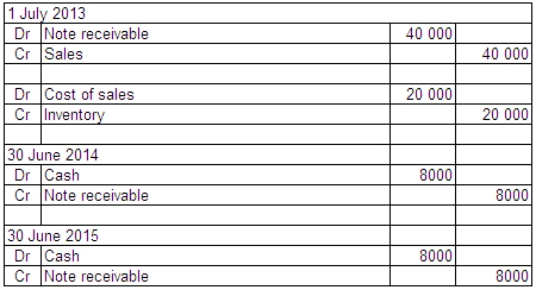

A)

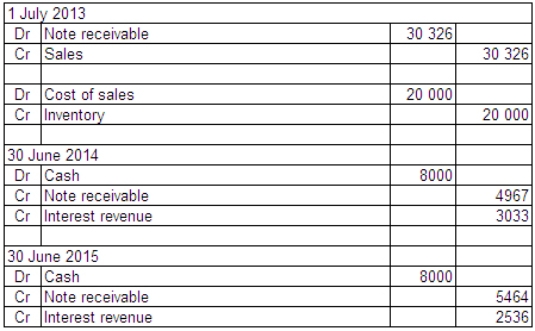

B)

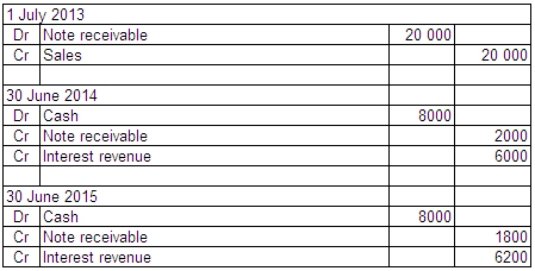

C)

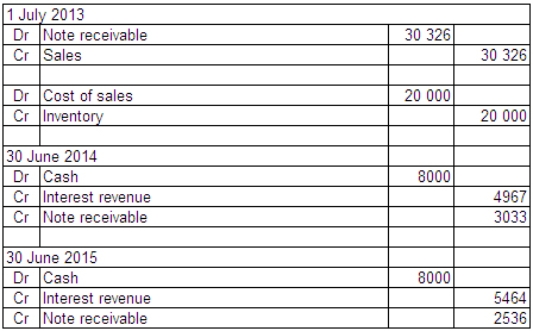

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Under the AASB (IASB)Conceptual Framework an increase

Q14: Which of the following statements is incorrect

Q15: Daniel Ltd sells one of its properties

Q16: The following is a diagram of the

Q17: Explain the accounting treatment when a third

Q19: When the cost basis is used to

Q20: An entity shall recognise revenue from a

Q21: On 1 July 2013 Bigwell Ltd sells

Q22: When making a provision for doubtful debts,debtors'

Q23: Transactions that result in an inflow of