Multiple Choice

Burchells Ltd owns a machine that originally cost $36 000.It has been depreciated using the straight-line method for 3 years,giving an accumulated depreciation of $15 000 (the salvage value was estimated at $6000 and the useful life at 6 years) .At the beginning of the current financial year its carrying value is therefore $21 000.It has been decided by the directors to revalue it to fair value,which is assessed to be $38 000.The salvage value and useful life are considered to be unchanged.What are the appropriate entries to record the revaluation using the net method and the depreciation expense for the current year (rounded to the nearest dollar) ?

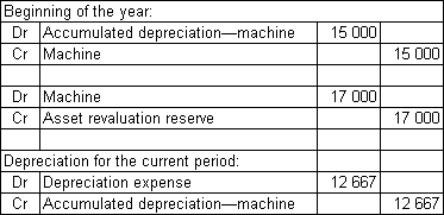

A)

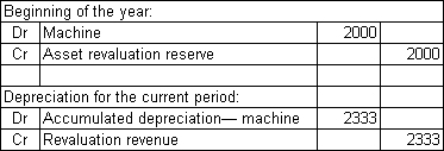

B)

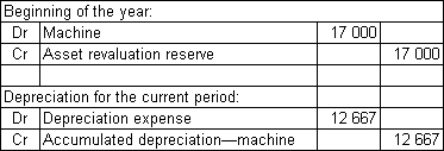

C)

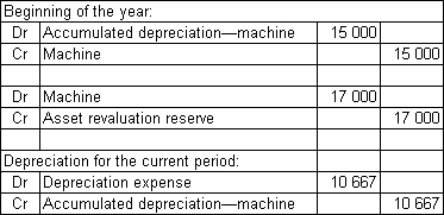

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q59: Australia is the only country that allows

Q60: A sale of property plant and equipment

Q61: Palm Beach Ltd has elected to

Q62: Explain why the accounting treatment from increments

Q63: Where an asset's carrying amount based on

Q65: Staples Ltd has invested in two

Q66: AASB 116 requires that if it has

Q67: Where management's bonuses are tied to profit-based

Q68: Positive Accounting Theory suggests that the revalution

Q69: Which of the following statements is a