Multiple Choice

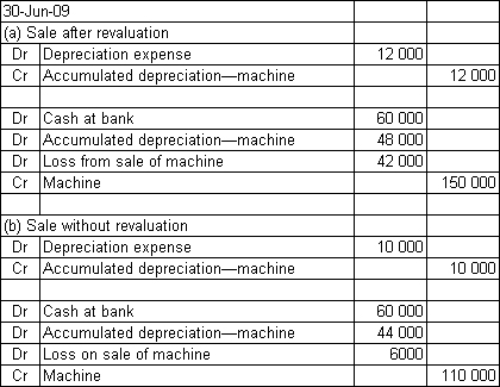

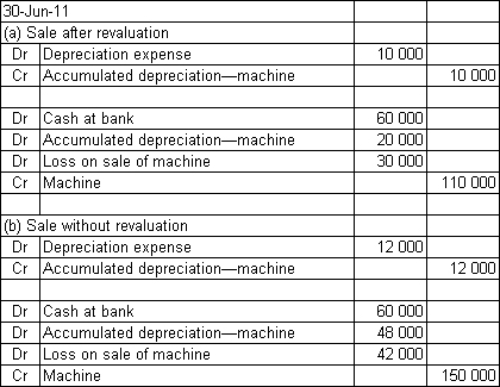

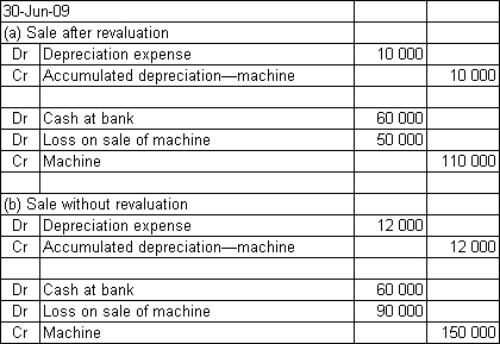

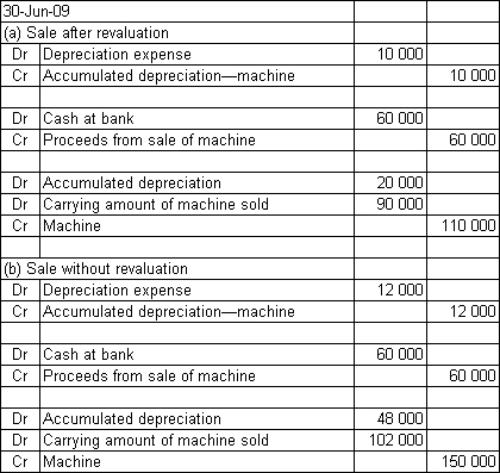

Bears and Things acquired a toy-stuffing machine at a cost of $150 000 on 1 July 2009.The machine had a useful life of 10 years and a residual value of $30 000.The benefits from the machine are expected to be derived evenly over its life.On 1 July 2011 the asset's fair value is $110 000 and the salvage value and useful life are expected to be unchanged (that is,there is 8 years of remaining life) .On 30 June 2009 the machine is sold for $60 000 cash.What are the journal entries required to record the depreciation for the year ended 30 June 2009 and the sale of the machine in accordance with AASB 116 if: (a) the revaluation is undertaken and (b) the revaluation is not recorded?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: If an asset's carrying amount is impaired,AASB

Q2: Manchester Ltd has a building that

Q4: Once an entity elects to value a

Q5: The costs associated with revaluing assets include:<br>A)

Q6: Where the value of revalued non-current assets

Q7: Discuss the potential usefulness of the gross

Q8: Hendersons Ltd has just begun to

Q9: Under AASB 116 when an asset is

Q10: By permitting some classes of assets to

Q11: Research using the Positive Accounting Theory approach