Multiple Choice

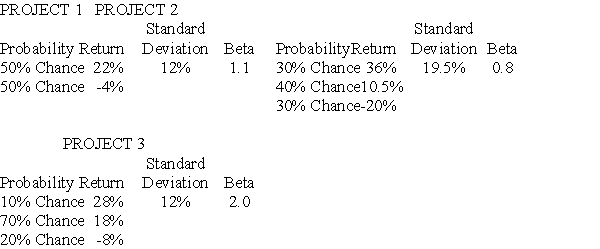

You are going to add one of the following three projects to your already well-diversified portfolio.  Assume the risk-free rate of return is 2% and the market risk premium is 8%.If you are a risk averse investor,which project should you choose?

Assume the risk-free rate of return is 2% and the market risk premium is 8%.If you are a risk averse investor,which project should you choose?

A) Project 1

B) Project 2

C) Project 3

D) Either Project 2 or Project 3 because the higher expected return on project 3 offsets its higher risk.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: A security with a beta of one

Q34: Because risk is measured by variability of

Q51: Joe purchased 800 shares of Robotics Stock

Q52: Assume that you expect to hold a

Q56: You are considering a security with the

Q57: Actual returns are always less than expected

Q57: Which of the following statements is most

Q77: The beta of ABC Co.stock is the

Q95: The appropriate measure for risk according to

Q143: Security A has an expected rate of