Essay

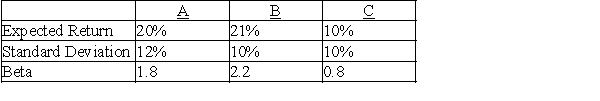

Answer the questions below using the following information on stocks A,B,and C.

Assume the risk-free rate of return is 3% and the expected market return is 12%

Assume the risk-free rate of return is 3% and the expected market return is 12%

a.Calculate the required return for stocks A,B,and C.

b.Assuming an investor with a well-diversified portfolio,which stock would the investor want

to add to his portfolio?

c.Assuming an investor who will invest all of his money into one security,which stock will the investor choose?

Correct Answer:

Verified

a.Stock A: 3% + (12% - 3%)(1.8)= 19.2%

S...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

S...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: The capital asset pricing model<br>A) provides a

Q28: The required rate of return for an

Q60: The benefits of diversification occur as long

Q70: Collectibles Corp.has a beta of 2.5 and

Q73: Which of the following statements is most

Q76: An investor currently holds the following portfolio:<br><img

Q78: If you hold a portfolio made up

Q82: Historically,investments with the highest returns have the

Q105: The minimum rate of return necessary to

Q138: In general,the required rate of return is