Essay

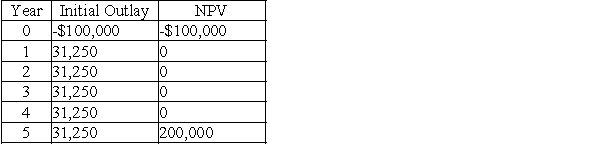

The Bolster Company is considering two mutually exclusive projects:

The required rate of return on these projects is 12 percent.

The required rate of return on these projects is 12 percent.

a.What is each project's payback period?

b.What is each project's discounted payback period?

c.What is each project's net present value?

d.What is each project's internal rate of return?

e.Fully explain the results of your analysis.Which project do you prefer,and why?

Correct Answer:

Verified

a.Payback of A = 3.2 years Payback of B ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Many financial managers believe the payback period

Q9: The discounted payback period takes the time

Q11: The modified internal rate of return represents

Q47: One of the disadvantages of the payback

Q70: An independent project should be accepted if

Q99: One positive feature of the payback period

Q104: A project with a NPV of zero

Q106: If a firm imposes a capital constraint

Q117: Zellars,Inc.is considering two mutually exclusive projects,A and

Q118: Zellars,Inc.is considering two mutually exclusive projects,A and