Multiple Choice

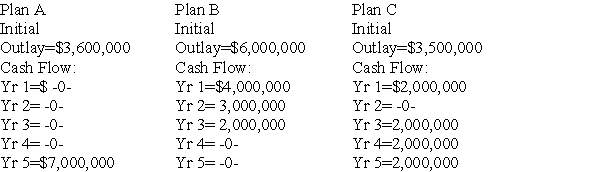

The Kitchen Inc.is considering the following 3 mutually exclusive projects.Projected cash flows for these ventures are as follows: If the Kitchen has a 12% cost of capital,what decision should be made regarding the projects above?

If the Kitchen has a 12% cost of capital,what decision should be made regarding the projects above?

A) Accept plan A

B) Accept plan B

C) Accept plan C

D) Accept Plans A, B and C

Correct Answer:

Verified

Correct Answer:

Verified

Q55: The payback period ignores the time value

Q74: Patrick Motors has several investment projects under

Q77: Zellars,Inc.is considering two mutually exclusive projects,A and

Q83: Marketing is crucial to capital budgeting success

Q83: A significant disadvantage of the internal rate

Q86: Two projects are mutually exclusive if the

Q95: The mutually exclusive project with the highest

Q100: The net present value always provides the

Q113: The internal rate of return is<br>A) the

Q114: The profitability index is the ratio of