Essay

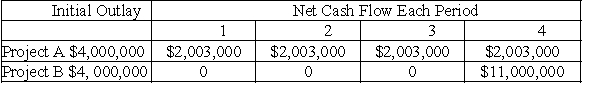

Consider the following two projects:

a.Calculate the net present value of each of the above projects,assuming a 14 percent discount rate.

a.Calculate the net present value of each of the above projects,assuming a 14 percent discount rate.

b.What is the internal rate of return for each of the above projects?

c.Compare and explain the conflicting rankings of the NPVs and IRRs obtained in parts a and b above.

d.If 14 percent is the required rate of return,and these projects are independent,what decision should be made?

e.If 14 percent is the required rate of return,and the projects are mutually exclusive,what decision should be made?

Correct Answer:

Verified

a.NPV of A = $1,836,166 NPV of B = $2,51...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: The discounted payback period takes the time

Q13: A project's IRR is analogous to the

Q68: The internal rate of return is the

Q80: NPV is the most theoretically correct capital

Q98: NPV assumes reinvestment of intermediate free cash

Q106: If a firm imposes a capital constraint

Q117: Zellars,Inc.is considering two mutually exclusive projects,A and

Q118: Zellars,Inc.is considering two mutually exclusive projects,A and

Q121: Whenever the internal rate of return on

Q136: Free cash flows represent the benefits generated