Essay

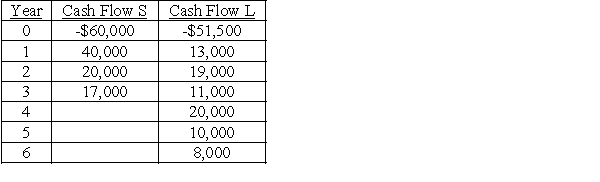

The Dickerson PR Firm is considering two mutually exclusive projects with useful lives of 3 and 6 years.The after-tax cash flows for projects S and L are listed below.

Calculate the equivalent annual annuity for each project assuming a required return of 15%.What decision should be made?

Calculate the equivalent annual annuity for each project assuming a required return of 15%.What decision should be made?

Correct Answer:

Verified

Choose Project S.Although the NPV of Pro...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: If a project has multiple internal rates

Q55: The payback period ignores the time value

Q59: An acceptable project should have a net

Q67: Rent-to-Own Equipment Co.is considering a new inventory

Q72: Which of the following statements is most

Q74: Patrick Motors has several investment projects under

Q77: Arguments against using the net present value

Q96: Which of the following statements about the

Q100: The net present value always provides the

Q150: Your firm is considering an investment that