Essay

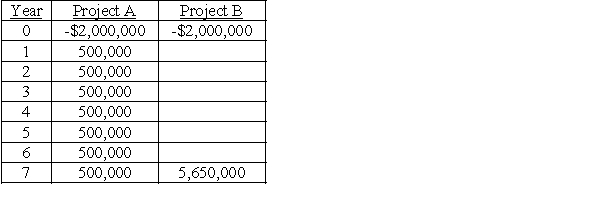

Company K is considering two mutually exclusive projects.The cash flows of the projects are as follows:

a.Compute the NPV and IRR for the above two projects,assuming a 13% required rate of return.

a.Compute the NPV and IRR for the above two projects,assuming a 13% required rate of return.

b.Discuss the ranking conflict.

c.What decision should be made regarding these two projects?

Correct Answer:

Verified

a.NPV of A = $211,305 NPV of B = $401,59...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Mutually exclusive projects have more than one

Q47: If project A generates $10 million of

Q48: Determine the five-year equivalent annual annuity of

Q67: Your company is considering an investment in

Q94: If a project's internal rate of return

Q129: Because the MIRR assumes reinvestment at the

Q144: Consider two mutually exclusive projects X and

Q146: NPV may be calculated on an Excel

Q152: Compute the discounted payback period for a

Q154: Northwest Industries is considering a project with