Essay

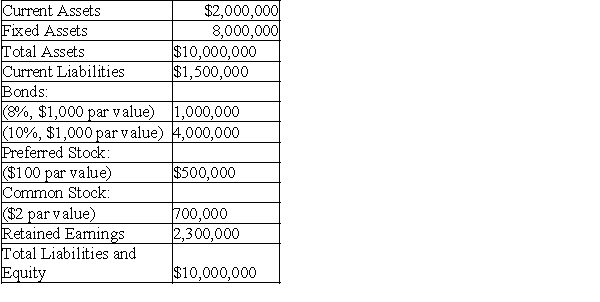

The MAX Corporation is planning a $4,000,000 expansion this year.The expansion can be financed by issuing either common stock or bonds.The new common stock can be sold for $60 per share.The bonds can be issued with a 12 percent coupon rate.The firm's existing shares of preferred stock pay dividends of $2.00 per share.The company's corporate income tax rate is 46 percent.The company's balance sheet prior to expansion is as follows:

MAX Corporation

a.Calculate the indifference level of EBIT between the two plans.

a.Calculate the indifference level of EBIT between the two plans.

b.If EBIT is expected to be $3 million,which plan will result in higher EPS?

Correct Answer:

Verified

a.

(350,000)[EBIT(.54)-$269,200] = (41...

(350,000)[EBIT(.54)-$269,200] = (41...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: One danger of EBIT-EPS analysis is that

Q27: If a company sells bonds and uses

Q76: As production levels increase,fixed costs stay the

Q82: Benkart's Tire Store has fixed costs of

Q82: The "threat hypothesis"<br>A) reduces management's tendency to

Q83: Which of the following would not be

Q87: Abrams Steel Company has very high operating

Q88: Business risk refers to the relative dispersion

Q139: Companies that sell basic necessities face the

Q146: A firm's optimal capital structure occurs where?<br>A)