Essay

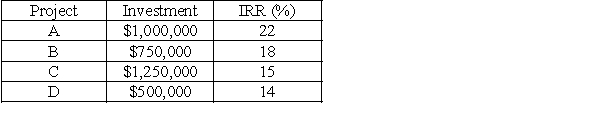

The Clydesdale Corporation has an optimal capital structure consisting of 70 percent debt and 30 percent equity.The marginal cost of capital is calculated to be 14.75 percent.Total earnings available to common stockholders for the coming year total $1,200,000.Investment opportunities are:

a.According to the residual dividend theory,what should the firm's total dividend payment be?

a.According to the residual dividend theory,what should the firm's total dividend payment be?

b.If the firm paid a total dividend of $675,000,and restricted equity financing to internally generated funds,which projects should be selected?

Assume the marginal cost of capital is constant.

Correct Answer:

Verified

a.

Select projects A,B,C for an investme...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Select projects A,B,C for an investme...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: According to the clientele effect,<br>A) companies should

Q4: Which of the following strategies may be

Q5: Shareholders may prefer a share repurchase program

Q15: From the shareholders' perspective,a stock repurchase has

Q51: Security markets are considered to be perfect

Q55: Describe the types of dividend policies that

Q76: Expected dividends and share repurchases are the

Q95: In a perfect market,investors are only concerned

Q146: Statutory restrictions on dividend payments include all

Q155: Dryden,Corp.has 500,000 shares of common stock outstanding,a