Essay

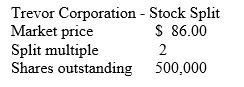

Kelly owns 10,000 shares in McCormick Spices,which currently has 500,000 shares outstanding.The stock sells for $86 on the open market.McCormick's management has decided on a two-for-one split.

a.Will Kelly's financial position change after the split,assuming that the stock's price will fall proportionately?

b.Assuming only a 35% decrease in the stock price,what will be Kelly's value after the split?

b.Assuming only a 35% decrease in the stock price,what will be Kelly's value after the split?

Correct Answer:

Verified

Correct Answer:

Verified

Q13: According to the perfect markets approach to

Q58: Because of the overriding importance of cash

Q71: SEC regulations require that corporate stock repurchases

Q74: The "bird-in-the-hand dividend theory" supports which view

Q81: Stock dividends<br>A) decrease stock prices because no

Q106: While Captive,Inc.has been in business for over

Q107: Stock repurchases may be used for all

Q109: A stock repurchase may be viewed as<br>A)

Q112: Corporation A's dividend policy is to maintain

Q116: All of the following are rationales given