Essay

The City of Carlsbad established a Stores and Services Fund.To provide working capital,the Stores and Services Fund borrowed $800,000 from the General Fund,to be paid back over 8 years with no interest.The Stores and Services Fund is expected to set user charges at a level which will recover all expenses and provide cash for the repayment of the loan.

Capital assets used by the Stores and Services Fund include a building which cost $350,000 and had a 10 year life,and equipment which cost $200,000 and had a 5 year life.Straight-line depreciation is to be used,with no salvage value.

Capital assets used by the Stores and Services Fund include a building which cost $350,000 and had a 10 year life,and equipment which cost $200,000 and had a 5 year life.Straight-line depreciation is to be used,with no salvage value.

Required:

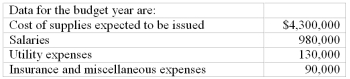

a.Prepare a break-even budget for the City of Carlsbad Stores and Services Fund.Include a mark up percentage,as a percentage of cost so that revenue will equal expenses.

b.Record the issuance of supplies,costing $16,500,to the Water Utility Fund.The perpetual inventory system is used.Show computations in good form.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Capital assets of an enterprise fund should

Q39: An enterprise fund is required if there

Q51: Which of the following would <b><u>not</b></u>

Q56: The Proprietary Fund Statement of Net Assets

Q105: Long term liabilities of an enterprise fund

Q107: Indicate which of the following would not

Q117: FASB requires that the reconciliation of income

Q119: Centralized purchasing,computer services,and janitorial services are examples

Q121: Which of the following is not true

Q124: Which of the following is correct with