Essay

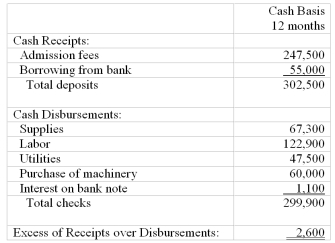

The following Statement of Cash Receipts and Disbursements was prepared by the bookkeeper of The Anchorage Arboretum Authority.The Arboretum Authority is a component unit of the City of Anchorage and must be included in the City's financial statements.It began operations on January 1,2012 with no outstanding liabilities or commitments and only 2 assets:

(1)$7,000 cash and (2)land that it had paid $12,000 to acquire.

● The loan from the bank is dated April 1 and is for a five year period.Interest (4% annual rate)is paid on Oct.1 and April 1 of each year,beginning October 1,2012.

● The loan from the bank is dated April 1 and is for a five year period.Interest (4% annual rate)is paid on Oct.1 and April 1 of each year,beginning October 1,2012.

● The machinery was purchased on April 1 with the proceeds provided by the bank loan and has an estimated useful life of 10 years.(straight-line basis)

● Supplies on hand amounted to $3,760 at December 31,2012.These included $500 of fertilizer that was received on December 29 and paid in January 2013.All other bills and salaries related to 2012 had been paid by close of business on December 31.

Required:

Part A.Prepare a Statement of Revenues,Expenses and Changes in Net Assets for the year ended 12-31-09 for the Arboretum assuming the City plans to account for its activities on the accrual basis.

Part B.Prepare a Statement of Revenues,Expenditures and Changes in Fund Balance for the year ended 12-31-09 for the Arboretum assuming the City plans to account for its activities on the modified accrual basis.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A city government has decided to build

Q41: Post-closure costs are recorded in a solid

Q74: Proprietary funds use the economic resources measurement

Q81: Which of the following is not an

Q82: GASB Statement 34 requires enterprise funds to

Q84: The excess of assets over liabilities of

Q86: Revenue bonds sold by a water utility

Q89: In the Statement of Net Assets for

Q90: An example of an internal service fund

Q129: GASB Cash Flow Statements requires four classifications