Essay

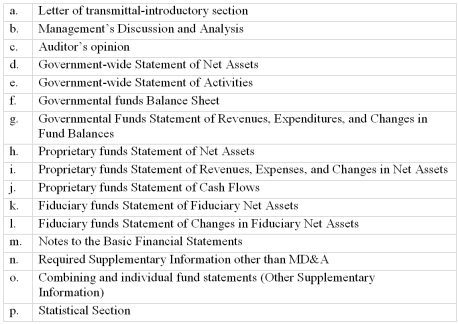

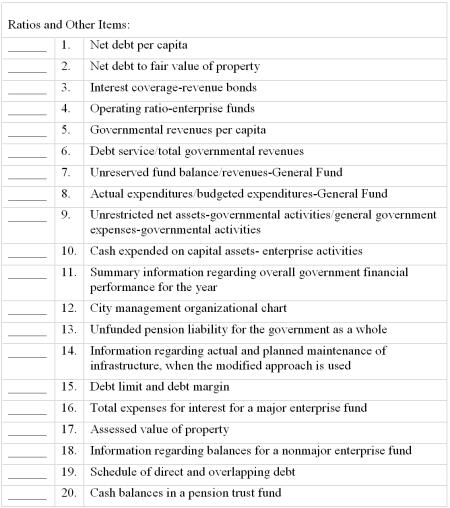

The Comprehensive Annual Financial Report of a local governmental unit includes several statements and sections.When a financial analyst is computing ratios and extracting other information,he or she needs to know where in the CAFR to look.Use the following classification to indicate where an analyst would look in the CAFR to compute the ratios and gather information by placing the appropriate letter(s)in the space next to each item.When possible,choose the location in the basic financial statements or notes that would be subject to examination:

Correct Answer:

Verified

1-d; 2-d,p; 3-i; 4-i; 5-g,p; 6...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Entities that are tax-exempt under Section 501c3

Q47: While the Sarbanes-Oxley Act applies only to

Q54: Supporting expenses are not included in the

Q108: Which of the following is not prohibited

Q110: Which of the following tax-exempt organizations would

Q111: Which of the following is true concerning

Q112: What is the correct hierarchy of performance

Q115: If an auditor is not independent which

Q116: Which of the following conditions would exempt

Q150: The program expense ratio for a not-for-profit