Multiple Choice

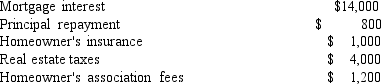

Jackie is in the 28% marginal tax bracket and has no other itemized deductions except those related to her home.If her standard deduction is $4,750 and she incurs the following costs related to housing,how much tax savings will she receive as a result of her home purchase?

A) $13,250

B) $ 5,040

C) $ 3,710

D) $ 2,800

E) none

Correct Answer:

Verified

Correct Answer:

Verified

Q117: Judy has $2,000 for a down payment

Q171: _ is a reason for preferring to

Q172: Private Mortgage Insurance (PMI)protects the lender from

Q173: INSTRUCTIONS: Choose the word or phrase in

Q174: The down payment on the car you

Q175: Terms of renting a housing unit may

Q177: One can increase the tax benefits of

Q178: In which of the following situations would

Q180: Condominium and Townhome owners can deduct real

Q181: _ is a fixed auto ownership cost.<br>A)