Multiple Choice

Austin incurs $3,600 for business meals while traveling for his employer,Tex,Inc.Austin is reimbursed in full by Tex pursuant to an accountable plan.What amounts can Austin and Tex deduct?

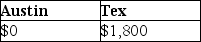

A)

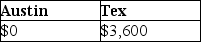

B)

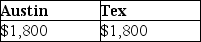

C)

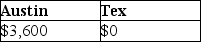

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Which of the following is true about

Q32: Alex is a self-employed dentist who operates

Q39: Wilson Corporation granted an incentive stock option

Q46: Travel expenses related to temporary work assignments

Q49: Jackson Corporation granted an incentive stock option

Q50: Clarissa is a very successful real estate

Q52: Sarah purchased a new car at the

Q53: Ellie,a CPA,incurred the following deductible education expenses

Q55: Which of the following statements regarding Health

Q56: Transportation expenses incurred to travel from one