Essay

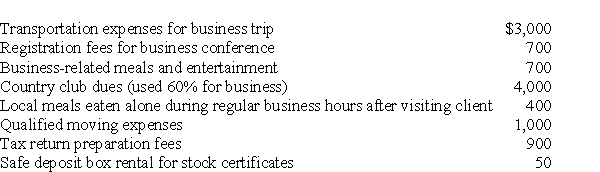

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation for the dues.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation for the dues.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Correct Answer:

Verified

The country club dues are no...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The country club dues are no...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Tobey receives 1,000 shares of YouDog! stock

Q31: Which of the following is true about

Q82: Jason,who lives in New Jersey,owns several apartment

Q85: Martin Corporation granted a nonqualified stock option

Q86: In addition to the general requirements for

Q89: Dues paid to social or athletic clubs

Q93: During 2017,Marcia,who is single and is covered

Q94: Tucker (age 52)and Elizabeth (age 48)are a

Q103: Chuck, who is self- employed, is scheduled

Q1743: Discuss the tax treatment of a nonqualified