Multiple Choice

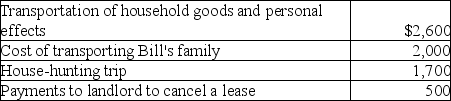

Bill obtained a new job in Boston.He incurred the following moving expenses:  Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

A) $2,600

B) $4,600

C) $6,300

D) $6,800

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: In-home office expenses are deductible if the

Q12: In-home office expenses which are not deductible

Q74: Which of the following statements is incorrect

Q82: Jason,who lives in New Jersey,owns several apartment

Q85: Martin Corporation granted a nonqualified stock option

Q86: Taxpayers may use the standard mileage rate

Q86: In addition to the general requirements for

Q89: Dues paid to social or athletic clubs

Q103: Chuck, who is self- employed, is scheduled

Q1326: Gina is an instructor at State University