Multiple Choice

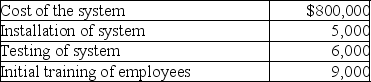

Terra Corp.purchased a new enterprise software system and incurred the following costs:  What is Terra Corp.'s basis in the software system?

What is Terra Corp.'s basis in the software system?

A) $800,000

B) $805,000

C) $811,000

D) $820,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q14: Taj Corporation has started construction of a

Q54: If the stock received as a nontaxable

Q71: Terrell and Michelle are married and living

Q102: Gains and losses are recognized when property

Q103: Bev has one daughter and three grandchildren.Bev

Q104: Dustin purchased 50 shares of Short Corporation

Q105: Adjusted net capital gain is taxed at

Q106: An uncle gifts a parcel of land

Q109: Jade is a single taxpayer in the

Q115: Gain on sale of a patent by