Multiple Choice

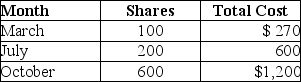

Edward purchased stock last year as follows:  In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

A) $160.

B) $184.

C) $216.

D) $240.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: If an individual taxpayer's net long-term capital

Q78: Kathleen received land as a gift from

Q83: If an individual taxpayer's net long-term capital

Q123: In 2015,Toni purchased 100 shares of common

Q124: Adam purchased 1,000 shares of Airco Inc.common

Q129: Emma Grace acquires three machines for $80,000,which

Q130: In the current year,Andrew received a gift

Q130: Net long-term capital gains receive preferential tax

Q131: During the current year,Tony purchased new car

Q133: Kendrick,who has a 33% marginal tax rate,had