Multiple Choice

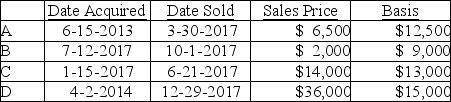

Coretta sold the following securities during 2017:  What is Coretta's net capital gain or loss result for the year?

What is Coretta's net capital gain or loss result for the year?

A) NSTCL of $3,000 and NLTCG of $15,000

B) $9,000 ANCG

C) $0

D) $12,000 ANCG

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: Taxpayers who own mutual funds recognize their

Q25: Sanjay is single and has taxable income

Q29: Amanda,whose tax rate is 33%,has NSTCL of

Q38: All of the following are capital assets

Q42: Brad owns 100 shares of AAA Corporation

Q53: If Houston Printing Co.purchases a new printing

Q84: David gave property with a basis of

Q87: Michelle purchased her home for $150,000,and subsequently

Q105: If a capital asset held for one

Q1861: Donald has retired from his job as