Multiple Choice

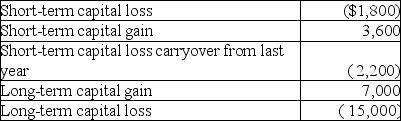

During the current year,Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

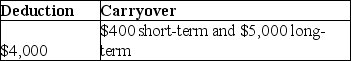

A)

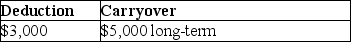

B)

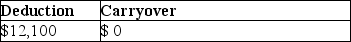

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Arthur,age 99,holds some stock purchased many years

Q33: On January 1 of this year,Brad purchased

Q39: Rick sells stock of Ty Corporation,which has

Q52: Candice owns a mutual fund that reinvests

Q56: Erik purchased qualified small business corporation stock

Q57: Margaret died on September 16,2017,when she owned

Q65: Tina,whose marginal tax rate is 33%,has the

Q120: Antonio owns land held for investment with

Q136: Stella has two transactions involving the sale

Q2205: What are arguments for and against preferential