Essay

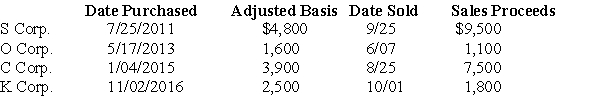

Mike sold the following shares of stock in 2017:

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

Correct Answer:

Verified

The net capital gain will be...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The net capital gain will be...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Olivia,a single taxpayer,has AGI of $280,000 which

Q11: Five different capital gain tax rates could

Q12: Funds borrowed and used to pay for

Q18: All recognized gains and losses must eventually

Q32: Jamahl and Indira are married and live

Q80: Kathleen received land as a gift from

Q95: Galvin Corporation has owned all of the

Q97: Antonio is single and has taxable income

Q100: Mike,a dealer in securities and calendar-year taxpayer,purchased

Q2127: Distinguish between the Corn Products doctrine and