Essay

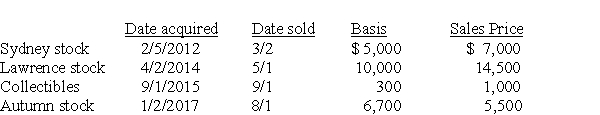

Chen had the following capital asset transactions during 2017:

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

Correct Answer:

Verified

Application of STCL:

(1)Apply to reduc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Application of STCL:

(1)Apply to reduc...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q14: Taj Corporation has started construction of a

Q30: Unless the alternate valuation date is elected,the

Q43: Monte inherited 1,000 shares of Corporation Zero

Q47: Allison buys equipment and pays cash of

Q54: If the stock received as a nontaxable

Q91: How long must a capital asset be

Q109: Jade is a single taxpayer in the

Q113: Gertie has a NSTCL of $9,000 and

Q115: Gain on sale of a patent by

Q119: In 2012,Regina purchased a home in Las