Multiple Choice

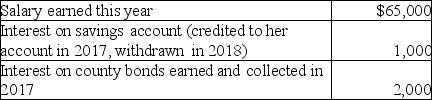

Ms.Marple's books and records for 2017 reflect the following information:  What is the amount Ms.Marple should include in her gross income in 2017?

What is the amount Ms.Marple should include in her gross income in 2017?

A) $66,000

B) $67,000

C) $68,000

D) $65,000

Correct Answer:

Verified

Correct Answer:

Verified

Q39: Under both the accounting and tax law

Q41: Speak Corporation,a calendar-year,cash-basis taxpayer,sells packages of foreign

Q42: Hoyt rented office space two years ago

Q45: Edward is considering returning to work part-time

Q48: Chance Corporation began operating a new retail

Q54: In addition to Social Security benefits of

Q55: Social Security benefits are excluded from taxation

Q72: The wherewithal-to-pay concept provides that a tax

Q104: Under the economist's definition,unrealized gains,as well as

Q2173: Marcia and Dave are separated and negotiating