Multiple Choice

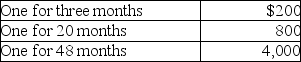

CT Computer Corporation,an accrual-basis taxpayer,sells service contracts on the computers it sells.At the beginning of January of this year,CT Corporation sold contracts with service to begin immediately:  The amount of income CT Corporation must report for this year is

The amount of income CT Corporation must report for this year is

A) $200.

B) $1,000.

C) $1,680.

D) $5,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Aaron found a prototype of a new

Q14: Eva and Lisa each retired this year

Q30: Amy's employer provides her with several fringe

Q34: Interest on the obligations of the U.S.government,states,territories,and

Q55: As a result of a divorce,Michael pays

Q58: Which of the following constitutes constructive receipt

Q61: Natasha is a single taxpayer with a

Q62: A taxpayer had the following income and

Q75: Earnings of a minor child are taxed

Q1592: Rocky owns The Palms Apartments. During the