Essay

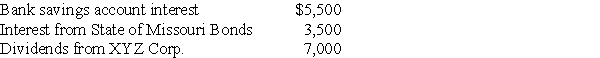

Kevin is a single person who earns $70,000 in salary for 2017 and has other income from a variety of investments,as follows:

Kevin received tax refunds when he filed his 2016 tax returns in April 2017.His federal refund was $600 and his state refund was $300.Kevin deducted his state taxes paid in 2016 as an itemized deduction on his 2016 return.Due to changes in circumstances,Kevin is not itemizing deductions on his 2017 return.

Kevin received tax refunds when he filed his 2016 tax returns in April 2017.His federal refund was $600 and his state refund was $300.Kevin deducted his state taxes paid in 2016 as an itemized deduction on his 2016 return.Due to changes in circumstances,Kevin is not itemizing deductions on his 2017 return.

Compute Kevin's taxable income for 2017.

Correct Answer:

Verified

The interest from the munici...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The interest from the munici...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: While using a metal detector at the

Q31: Betty is a single retiree who receives

Q65: The term "Social Security benefits" does not

Q87: The portion of a taxpayer's wages that

Q88: Todd and Hillary,husband and wife,file separate returns.Todd

Q97: Tarik,a single taxpayer,has AGI of $55,000 which

Q98: Adanya's marginal tax rate is 39.6% and

Q101: Gwen's marginal tax bracket is 25%.Gwen pays

Q101: One of the requirements that must be

Q2129: Ron and Eve are a married couple