Essay

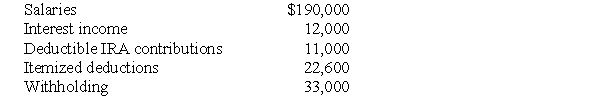

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2017.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax),rounded to the nearest dollar?

e.What is the amount of their tax due or (refund due)?

Correct Answer:

Verified

Correct Answer:

Verified

Q15: If a 13-year-old has earned income of

Q16: Annisa,who is 28 and single,has adjusted gross

Q17: Which of the following types of itemized

Q18: Keith,age 17,is a dependent of his parents.During

Q19: Steve Greene,age 66,is divorced with no dependents.In

Q21: If an individual with a marginal tax

Q22: Charlie is claimed as a dependent on

Q23: Generally,in the case of a divorced couple,the

Q25: A single taxpayer provided the following information

Q93: A taxpayer is able to change his