Essay

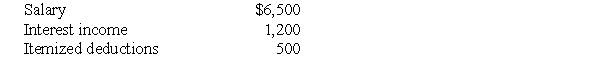

The following information for 2017 relates to Emma Grace,a single taxpayer,age 18:

a.Compute Emma Grace's taxable income assuming she is self-supporting.

a.Compute Emma Grace's taxable income assuming she is self-supporting.

b.Compute Emma Grace's taxable income assuming she is a dependent of her parents.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Taquin,age 67 and single,paid home mortgage interest

Q32: Steven and Susie Tyler have three dependent

Q34: Sally divorced her husband three years ago

Q39: Frank,age 17,received $4,000 of dividends and $1,500

Q40: A married person who files a separate

Q70: A married couple need not live together

Q77: Generally,itemized deductions are personal expenses specifically allowed

Q83: Juanita's mother lives with her.Juanita purchased clothing

Q101: A qualifying child of the taxpayer must

Q824: Discuss why Congress passed the innocent spouse