Multiple Choice

Joey and Bob each have 50% interest in a Partnership.Both Joey and the partnership file returns on a calendar-year basis.Partnership Q had a $12,000 loss in 2016.Joey's adjusted basis in his partnership interest on January 1,2016,was $5,000.In 2017,the partnership had a profit of $10,000.Assuming there were no other adjustments to Joey's basis in the partnership,what amount of partnership income (loss) should Joey show on his 2016 and 2017 individual income tax returns?

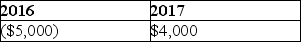

A)

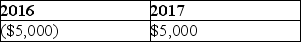

B)

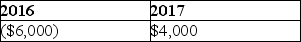

C)

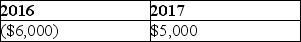

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Ben is a 30% partner in a

Q33: A partnership is generally required to use

Q69: Stephanie owns a 25% interest in a

Q112: Patrick acquired a 50% interest in a

Q119: All of the following could file partnership

Q125: Limited liability of partners or members is

Q136: Brittany receives a nonliquidating distribution of $48,000

Q139: The basis of a partnership interest is

Q1003: Discuss whether a C corporation, a partnership,

Q1746: What is the primary purpose of Form