Essay

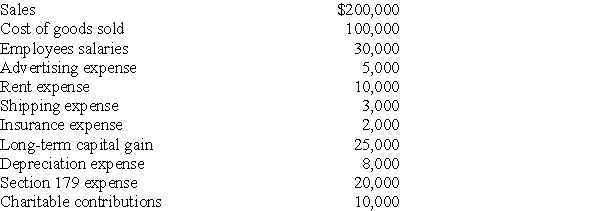

Longhorn Partnership reports the following items at the end of the current year:

What is the partnership's ordinary income? Which items are separately stated?

What is the partnership's ordinary income? Which items are separately stated?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: A contribution of services to a partnership

Q19: The partnership's assumption of a liability from

Q49: Sari transferred an office building with a

Q54: All of the following are separately stated

Q79: S corporations are a common form for

Q86: At the beginning of this year,Edmond and

Q107: Members of a single family may be

Q114: The primary purpose of a partnership tax

Q334: Charlie Company is a partnership with two

Q1958: Explain the difference between expenses of organizing