Multiple Choice

To help retain its talented workforce,Zapper Corporation opens a child care facility in the building next to its offices.It spends $200,000 on rent,salaries and supplies.With respect to the $200,000 expenditure,Zapper will be entitled to a tax credit and a tax deduction of

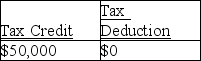

A)

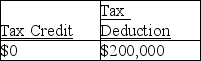

B)

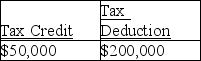

C)

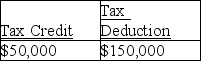

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q25: A couple has filed a joint tax

Q110: Research expenses eligible for the research credit

Q122: A credit is available to encourage employers

Q123: John has $55,000 of self-employment earnings from

Q124: Jay and Cara's daughter is starting her

Q126: Octo Corp.purchases a building for use in

Q129: In computing AMTI,all of the following must

Q132: In 2017,Rita is divorced with one child.She

Q133: A self-employed individual has earnings from his

Q908: Discuss tax- planning options available for expenses