Essay

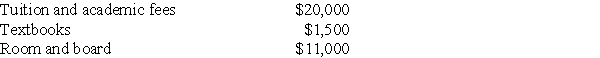

Burton and Kay are married,file a joint return with an AGI of $116,000,and have one dependent child,Tyler,who is a full-time student in a Master of Accountancy program.The following expenses relate to his costs of attendance in 2017:

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

Correct Answer:

Verified

Tyler is eligible for the Lifetime Learn...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q55: Nonrefundable tax credits<br>A)only offset a taxpayer's tax

Q56: Mr.and Mrs.Lewis have an alternative minimum tax

Q57: Individuals who do not have minimum essential

Q58: The itemized deduction phase-out,which has the effect

Q61: Marguerite and Josephus have two children,ages 13

Q63: Jeffery and Cassie,who are married with modified

Q66: All of the following statements regarding self-employment

Q82: Form 6251,Alternative Minimum Tax,must be filed in

Q96: Qualified tuition and related expenses eligible for

Q102: The Lifetime Learning Credit is partially refundable.