Essay

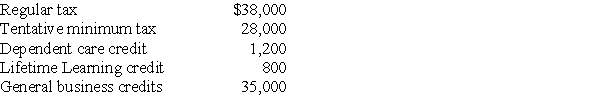

Ivan has generated the following taxes and credits this year:

How much general business credit will he apply to the current year tax liability?

How much general business credit will he apply to the current year tax liability?

Correct Answer:

Verified

The general business credit is applied...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The general business credit is applied...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Current year foreign taxes paid exceed the

Q42: The nonrefundable disabled access credit is available

Q55: In computing AMTI,tax preference items are<br>A)excluded.<br>B)added only.<br>C)subtracted

Q57: The foreign tax credit is equal to

Q69: The general business credits are refundable credits.

Q71: Hong earns $127,300 in her job as

Q77: George and Meredith who are married,have a

Q78: Doggie Rx Inc.is a new company developing

Q94: Nonrefundable personal tax credits can only offset

Q130: In computing AMTI,adjustments are<br>A)limited.<br>B)added only.<br>C)subtracted only.<br>D)either added