Essay

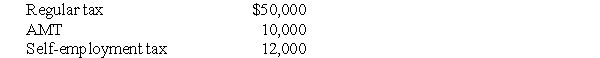

Beth and Jay project the following taxes for the current year:

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a.Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b.Preceding tax year-AGI of $155,000 and total taxes of $48,000.

Correct Answer:

Verified

a.The taxpayers should pay i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

a.The taxpayers should pay i...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Lee and Whitney incurred qualified adoption expenses

Q25: Jorge has $150,000 of self-employment earnings from

Q27: Lara started a self-employed consulting business in

Q28: Carlotta,Inc. ,has $50,000 foreign-source income and $150,000

Q29: During the year,Jim incurs $500,000 of rehabilitation

Q39: Shafiq,age 16,works part-time at the local supermarket

Q49: Timothy and Alice,who are married with modified

Q58: In lieu of a foreign tax credit,a

Q111: The general business credit includes all of

Q123: Bob's income can vary widely from year-to-year