Multiple Choice

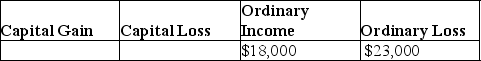

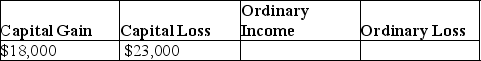

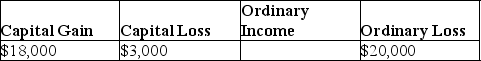

Jeremy has $18,000 of Sec.1231 gains and $23,000 of Sec.1231 losses.The gains and losses are characterized as

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: A corporation owns many acres of timber,which

Q17: All of the following statements regarding Sec.1245

Q63: Which of the following assets is 1231

Q76: During the current year,Danika recognizes a $30,000

Q80: Brian purchased some equipment in 2017 which

Q84: The following gains and losses pertain to

Q85: The sale of inventory results in ordinary

Q86: Jed sells an office building during the

Q87: On June 1,2014,Buffalo Corporation purchased and placed

Q88: An individual taxpayer sells a business building