Multiple Choice

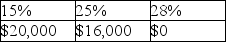

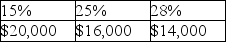

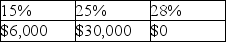

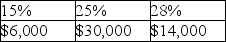

Yelenis,whose tax rate is 28%,sells one Sec.1231 asset this year,resulting in a $50,000 gain.Included in the $50,000 Sec.1231 gain is $30,000 of unrecaptured Sec.1250 gain.A review of Yelenis tax files for the past five years indicates one prior Sec.1231 sale which resulted in a $14,000 loss.The gain will be taxed as

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Installment sales of depreciable property which result

Q11: Mark owns an unincorporated business and has

Q20: The additional recapture under Sec.291 is 25%

Q23: If the recognized losses resulting from involuntary

Q31: Gains and losses from involuntary conversions of

Q49: Pierce has a $16,000 Sec.1231 loss,a $12,000

Q59: Sec.1231 property must satisfy a holding period

Q63: In 2017,Thomas,who has a marginal tax rate

Q83: Dinah owned land with a FMV of

Q93: Sec.1245 applies to gains on the sale