Multiple Choice

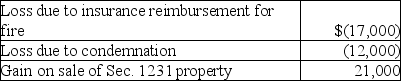

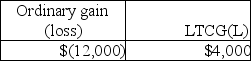

This year Jenna had the gains and losses noted below on property,plant and equipment used in her business.Each asset had been held longer than one year.Jenna has not previously disposed of any business assets.  Jenna will recognize

Jenna will recognize

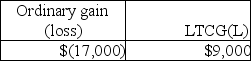

A)

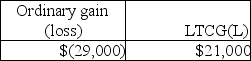

B)

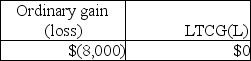

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q12: When gain is recognized on an involuntary

Q14: Depreciable property placed in service nine months

Q22: Emily,whose tax rate is 28%,owns an office

Q23: Blair,whose tax rate is 28%,sells one tract

Q24: Emma owns a small building ($120,000 basis

Q25: Ross purchased a building in 1985,which he

Q30: Elaine owns equipment ($23,000 basis and $15,000

Q31: Cassie owns equipment ($45,000 basis and $30,000

Q32: Pam owns a building used in her

Q57: In 1980,Mr.Lyle purchased a factory building to