Essay

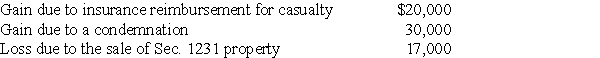

The following are gains and losses recognized in 2017 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

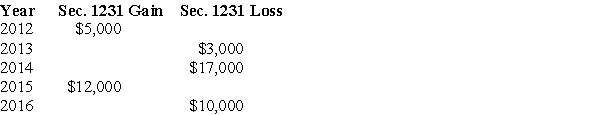

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Correct Answer:

Verified

The $20,000 gain from the casualty is tr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Installment sales of depreciable property which result

Q22: During the current year,George recognizes a $30,000

Q23: If the recognized losses resulting from involuntary

Q49: Pierce has a $16,000 Sec.1231 loss,a $12,000

Q51: Sec.1231 property will generally have all the

Q63: In 2017,Thomas,who has a marginal tax rate

Q69: Jaiyoun sells Sec.1231 property this year,resulting in

Q71: Clarise bought a building three years ago

Q80: If Sec.1231 applies to the sale or

Q1719: What is the purpose of Sec. 1245