Multiple Choice

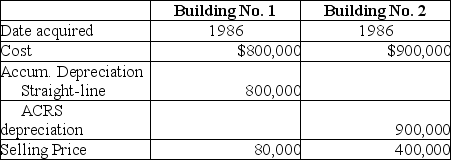

An unincorporated business sold two warehouses during the current year.The straight-line depreciation method was used for the first building and the accelerated method (ACRS) was used for the second building.Information about those buildings is presented below.  How much gain from these sales should be reported as Sec.1231 gain and ordinary income due to depreciation recapture by the owner of the business?

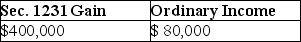

How much gain from these sales should be reported as Sec.1231 gain and ordinary income due to depreciation recapture by the owner of the business?

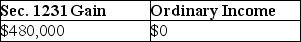

A)

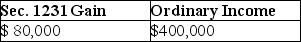

B)

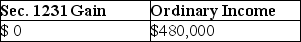

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Four years ago,Otto purchased farmland for $600,000

Q5: Frisco Inc.,a C corporation,placed a building in

Q40: During the current year,a corporation sells equipment

Q41: Gain due to depreciation recapture is included

Q87: When corporate and noncorporate taxpayers sell real

Q101: Harry owns equipment ($50,000 basis and $38,000

Q102: Pete sells equipment for $15,000 to Marcel,his

Q104: Describe the tax treatment for a noncorporate

Q107: WAM Corporation sold a warehouse during the

Q109: Hilton,a single taxpayer in the 28% marginal