Multiple Choice

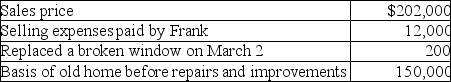

Frank,a single person,sold his home this year.He had owned and lived in the house for 10 years.Frank signed a contract on March 4 to sell his home and closed the sale on May 3.  Based on these facts,what is the amount of his recognized gain?

Based on these facts,what is the amount of his recognized gain?

A) $0

B) $39,800

C) $40,000

D) $52,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: Each of the following is true of

Q10: If real property used in a trade

Q37: Landry exchanged land with an adjusted basis

Q39: Real property exchanged for personal property,both held

Q42: A sale of property and subsequent purchase

Q60: If a taxpayer owns more than one

Q67: Replacing a building with land qualifies as

Q110: Kuda owns a parcel of land she

Q113: Kuda owns a parcel of land she

Q924: The basis of non- like- kind property