Multiple Choice

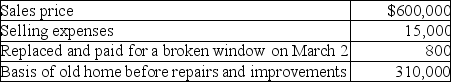

Pierce sold his home this year.He had owned and lived in the house for 10 years.Pierce signed a contract on March 4 to sell his home.  Based on these facts,what is the amount of his recognized gain?

Based on these facts,what is the amount of his recognized gain?

A) $0

B) $25,000

C) $40,000

D) $275,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q17: The holding period for boot property received

Q22: Lana owned a house used as a

Q39: Real property exchanged for personal property,both held

Q87: Mitchell and Debbie Dixon,a married couple,sell their

Q113: Kuda owns a parcel of land she

Q115: Summer exchanges an office building used in

Q118: An investor in artwork holds a Picasso

Q119: William and Kate married in 2017 and

Q122: In a nontaxable exchange,Henri traded in a

Q849: May a taxpayer elect under Sec. 1033