Multiple Choice

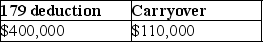

Caitlyn purchases and places in service property costing $450,000 in 2017.She wants to elect the maximum Sec.179 deduction allowed.The property does not qualify for bonus depreciation.Her business income is $400,000.What is the amount of her allowable Sec.179 deduction and carryover,if any?

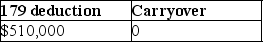

A)

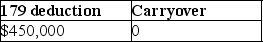

B)

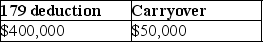

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Why would a taxpayer elect to capitalize

Q34: Sec.179 tax benefits are recaptured if at

Q47: Taxpayers are entitled to a depletion deduction

Q50: Under the MACRS system,automobiles and computers are

Q61: The election to use ADS is made

Q83: If personal-use property is converted to trade

Q83: This year Bauer Corporation incurs the following

Q86: On January 3,2014,John acquired and placed into

Q91: Harrison acquires $65,000 of 5-year property in

Q93: If a new luxury automobile is used