Essay

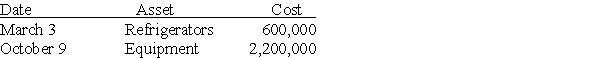

During the year 2017,a calendar-year taxpayer,Marvelous Munchies,a chain of specialty food shops,purchased equipment as follows:

Assume the property is all 5-year property,but does not qualify for bonus depreciation.What is the maximum depreciation that may be deducted for the assets this year,2017,assuming Sec.179 expensing is not elected?

Assume the property is all 5-year property,but does not qualify for bonus depreciation.What is the maximum depreciation that may be deducted for the assets this year,2017,assuming Sec.179 expensing is not elected?

Correct Answer:

Verified

The mid-quarter convention mus...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: On January l,Grace leases and places into

Q3: In November 2017,Kendall purchases a computer for

Q10: On November 3rd of this year,Kerry acquired

Q11: In April of 2016,Brandon acquired five-year listed

Q20: MACRS recovery property includes tangible personal and

Q35: Capital improvements to real property must be

Q37: In computing MACRS depreciation in the year

Q41: Costs that qualify as research and experimental

Q65: Atiqa took out of service and sold

Q85: Off-the-shelf computer software that is purchased for