Multiple Choice

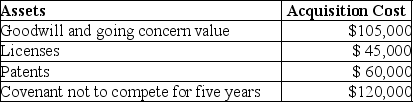

On January 1,2017,Charlie Corporation acquires all of the net assets of Rocky Corporation for $2,000,000.The following intangible assets are included in the purchase agreement:  What is the total amount of amortization allowed in 2017?

What is the total amount of amortization allowed in 2017?

A) $15,000

B) $22,000

C) $31,000

D) $38,000

Correct Answer:

Verified

Correct Answer:

Verified

Q14: If a company acquires goodwill in connection

Q21: Tronco Inc.placed in service a truck costing

Q38: Land,buildings,equipment,and common stock are examples of tangible

Q62: Which of the following statements regarding Sec.179

Q73: Galaxy Corporation purchases specialty software from a

Q74: On January 1 of the current year,Dentux

Q94: Ilene owns an unincorporated manufacturing business.In 2017,she

Q95: On October 2,2017,Dave acquired and placed into

Q98: Everest Corp.acquires a machine (seven-year property)on January

Q527: Discuss the options available regarding treatment of