Essay

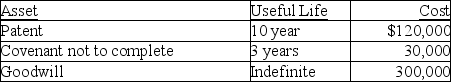

Stellar Corporation purchased all of the assets of Bellavia Company as of January 1 this year for $1 million.Included in the assets acquired are the following intangible assets:

What is Stellar's maximum amortization deduction for the year?

What is Stellar's maximum amortization deduction for the year?

Correct Answer:

Verified

The assets are Sec.197 acquisi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Enrico is a self-employed electrician.In May of

Q32: Residential rental property is defined as property

Q32: Quattro Enterprises,a calendar-year taxpayer,leases the twentieth floor

Q34: In April 2017,Emma acquired a machine for

Q35: Kenrick is an employee of the Theta

Q38: In accounting for research and experimental expenditures,all

Q41: In July of 2017,Pat acquired a new

Q53: Under what circumstances might a taxpayer elect

Q54: Amounts paid in connection with the acquisition

Q75: Depreciable property includes business,investment,and personal-use assets.