Essay

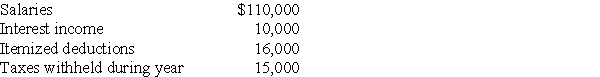

Brad and Angie had the following income and deductions during 2017:

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Correct Answer:

Verified

Tax = $10,452.50 + .25(95,90...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Tax = $10,452.50 + .25(95,90...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Which of the following taxes is regressive?<br>A)Federal

Q23: The IRS must pay interest on<br>A)all tax

Q41: Property is generally included on an estate

Q45: The computer is the primary tool of

Q58: Organizing a corporation as an S Corporation

Q59: The unified transfer tax system,comprised of the

Q61: The marginal tax rate is useful in

Q79: Which of the following individuals is most

Q82: Firefly Corporation is a C corporation.Freya owns

Q90: During the current tax year,Charlie Corporation generated