Essay

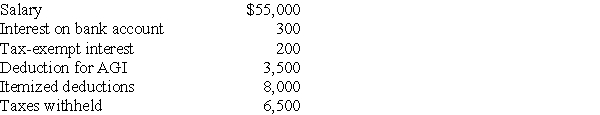

Chris,a single taxpayer,had the following income and deductions during 2017:

Calculate Chris's tax liability due or refund.

Calculate Chris's tax liability due or refund.

Correct Answer:

Verified

Tax $5,226.25 + .25(39,750 -...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Tax $5,226.25 + .25(39,750 -...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q5: Which of the following taxes is regressive?<br>A)Federal

Q41: Property is generally included on an estate

Q46: In an S corporation,shareholders<br>A)are taxed on their

Q58: Organizing a corporation as an S Corporation

Q61: The marginal tax rate is useful in

Q76: Kole earns $140,000 in 2017 in his

Q77: Alan files his 2016 tax return on

Q78: Jeffery died in 2017 leaving a $16,000,000

Q79: Charlotte pays $16,000 in tax deductible property

Q82: Helen,who is single,is considering purchasing a residence